เอ็ทน่า – ซันชายน์

ประกันสุขภาพแผนซันชายน์

เหมาะสำหรับ

ชาวต่างชาติที่จะเดินทางมาพักอาศัยอยู่ในประเทศไทย

เป็นระยะเวลา 6 เดือน

และกำลังมองหาประกันสุขภาพที่ให้ความคุ้มครองในระยะสั้นๆ

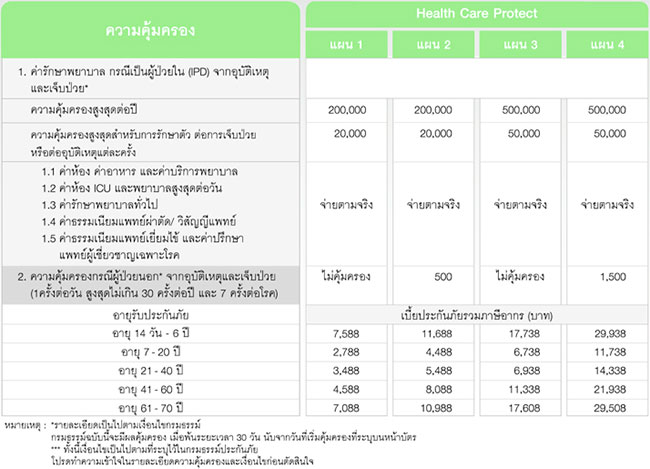

วงเงินความคุ้มครองในกรณีผู้ป่วยใน ครอบคลุมค่าใช้จ่ายของการเจ็บป่วยรวมถึงอุบัติเหตุ สูงสุดถึง 1 ล้านบาท

เครือข่ายโรงพยาบาลและคลินิกมากกว่า 300 แห่งทั่วประเทศ

เงื่อนไขการรับประกันภัย แผนซันชายน์ – เอ็ทน่า

Health insurance

This table of benefits should be read in conjunction with your policy documentation

This policy provides cover for 6 months only. The policy is non-cancelable and cannot be extended. If you plan to stay in Thailand for more than 6 months please ask our sales representatives about our wide selection of annual policies.

There needs to be a minimum 3-month break before a new 6-month policy will be issued. Members will need to complete a new application form

This policy is available for non-Thai nationalities only.

Worldwide, excluding USA.

Members must be over the age of 18 years and may apply up to and inclusive of the age of 70 years only.

Inpatient expenses are payable for any one disability. This means expenses relating to treatment for a condition or symptoms arising from the same cause including all complications. If the same disability should reoccur 90 days must elapse from the last treatment date for that disability to be considered a new disability.

Expensive tests such as MRI and CT scans and stress ECGs will be reimbursed under the inpatient hospital general expenses benefit provided they are appropriate and have been pre-authorised by Aetna in advance.

If you have more than one policy with Aetna Health Insurance the maximum amount insured for any one disability is 5 million baht.

Emergency assistance

The emergency medical assistance provides cover if you are 150 km. or more from your place of residence in Thailand.

ข้อยกเว้นความคุ้มครอง แผนซันชายน์ – เอ็ทน่า

Health insurance

Although you will be covered for the major costs of treatment, there are certain things that Aetna has to exclude. Full details of these can be found in your policy document. Some of the conditions which we cannot pay for are shown below:

Pre-existing conditions.

Investigations or treatment for the following diseases or conditions are not covered: tumors or cancers, polyps, cysts or benign tumors, hemorrhoids, hernias, pterygium pinguecula and cataract, tonsillectomy or adenoidectomy, stones, varicose veins, hallux valgus, ganglion and endometriosis.

Treatment which is not recommended by a doctor.

Birth control and treatment for infertility.

Hormone replacement therapy.

Treatment for congenital abnormalities.

Mental illness and stress related conditions.

Treatment arising from a self inflicted injury, suicide attempt, alcoholism, drug abuse or sexually transmitted diseases.

Eye examinations, eye laser treatment and cosmetic surgery.

Dental treatment.

HIV/AIDS and HIV related diseases.

Appliances such as spectacles, lenses, hearing aids or wheelchairs.

Transplant surgery and supportive treatment of renal failure.

Treatment for injury resulting from dangerous sport.

Personal accident

Aetna will cover you for loss of life, loss of sight, hearing and speech and dismemberment arising from injury due to external causes. However you will not be covered for losses arising from the following:

Dangerous sports.

Flying in a non-commercial aircraft or whilst serving as a crew member in any aircraft.

Being under the influence of drugs or alcohol.

Suicide or self inflicted injury.

For losses arising whilst driving or riding as a passenger on a motorcycle only 50% of the benefit will be paid. (Please note that eligible medical expenses will still be paid up to the maximum limits in the event of a motorcycle accident)

Bacterial infections.

Miscarriage resulting from an accident.

Taking part in a brawl.

Criminal acts.

War.

Radioactivity.